Aiding and abetting: How companies allow their sales force to throw money away

Pricing is the single most important driver of a company’s profitability. Exploiting even small pricing opportunities can lead to significant improvements in earnings. For example, for the average Eurostoxx 50 company, a price increase of 1% will increase earnings by 5.5%. Therefore, it is worthwhile to explore all options for price increases to ensure the maximisation of shareholder value. So don’t throw money away – price improvements of 2-5 percent are achievable.

One of the most common ways of capturing price improvements is by optimising transactional pricing, the list price net of all discounts and allowances.

Opportunities in Transactional Pricing

Management often views pricing in terms of list price setting, where the debate centres around whether price setting is an art (e.g. management’s “best guess”), or a mechanical process (e.g. pricing around the level of competitors or cost-plus). The truth is that optimal price setting is rarely achieved through either one of these routes. In fact there is more to pricing than just list price setting – equally if not more important, pricing is about “price getting”.

Capturing opportunities from transactional pricing delivers quick wins that can improve financial performance within a short timeframe. The key is to identify price “leakage”, the difference between the list price the company has decided to charge, and the actual unit price it ultimately receives.

Price variability often without rationale

It goes without saying that in many cases, some price variability is warranted, given customers’ different demand elasticity (price sensitivity). More importantly, that variability often has no good rationale, i.e. lower prices are not charged to higher elasticity customers, but rather are based on historic reasons or salesperson skills, and are therefore somewhat random. More worryingly, many companies are not even aware of the extent to which price leakages occur in their business. For example, in the packaged goods industry, lease agreements for end-of-aisle displays are a common source of obscurity.

The opportunity for improvement is startlingly widespread – price leakages occur in any situation where negotiable pricing exists, and in particular in industries where products are sold through distribution, or sold directly to a large number of diverse customers through a sales force.

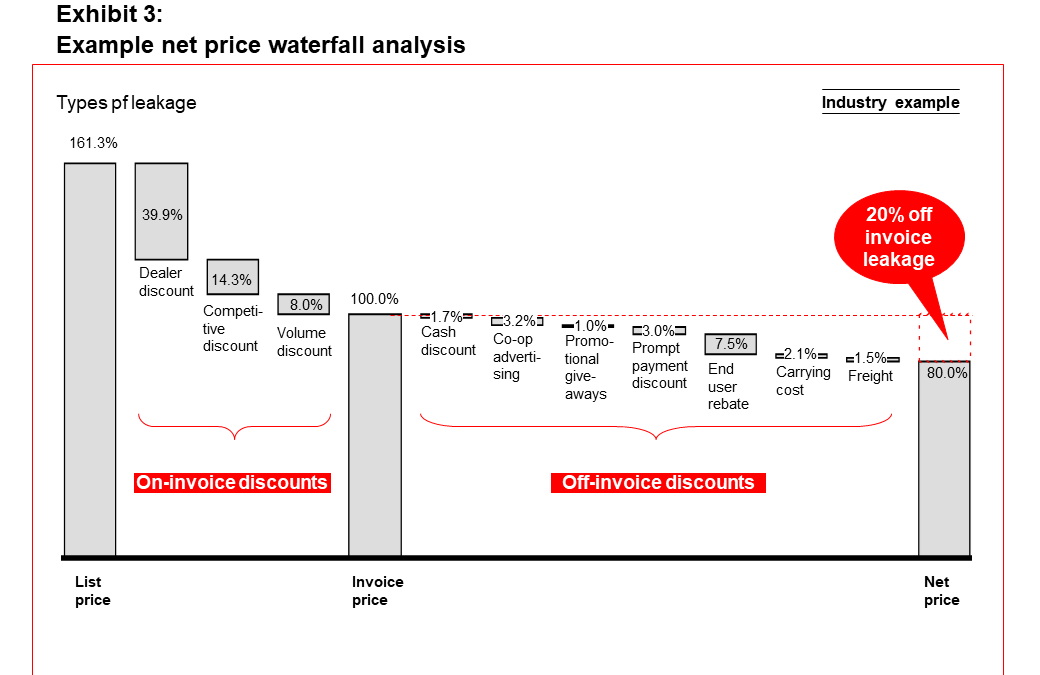

So how do companies capture these pricing improvements? A comprehensive effort to improve transactional pricing relies on the decision as to what net price (after discounts and allowances) should be charged to each customer. Exhibit 1 outlines this process of capturing the pricing improvements.

Identifying and Sizing the Opportunity

Several diagnostic tools can be used to quickly assess whether there is a transactional pricing improvement opportunity within a company. Typically, a positive answer to any of the questions at the end of this article would suggest that some opportunity exists. Interviews with management and sales force workshops provide a reasonably accurate picture of the company’s performance along these dimensions.

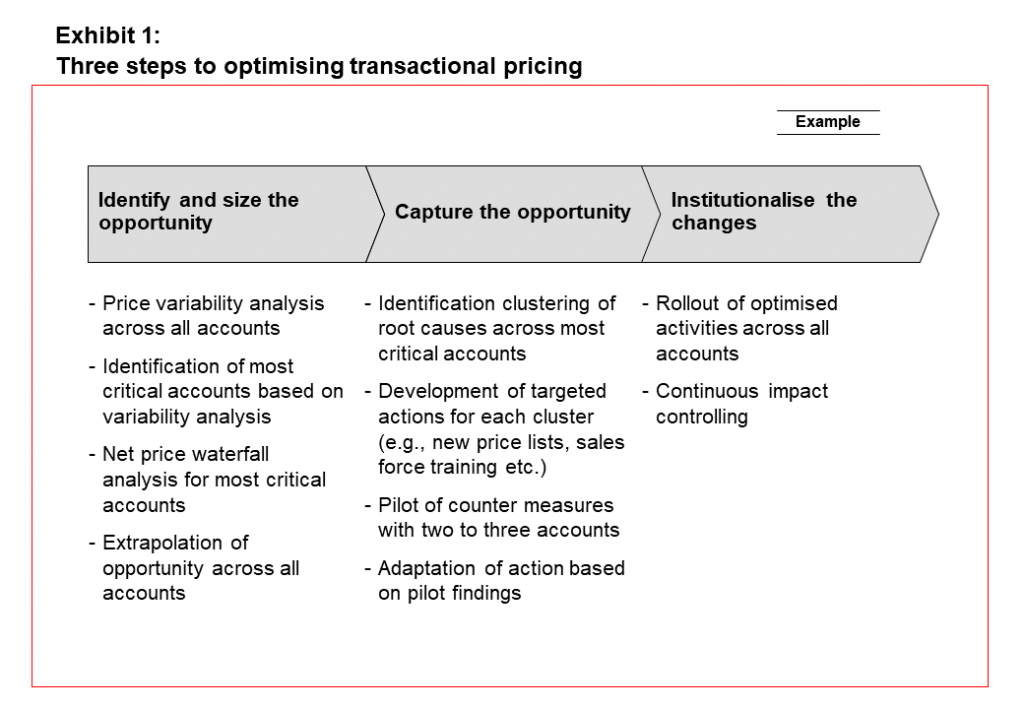

That being said, it is often the case that perceptions within an organisation are far removed from reality. Exhibit 2 shows a powerful analysis used to identify net price (discounting) variability. In numerous client situations, we found that the discount spread (the variability among the discount levels for a specific product) turned out to be several times larger than senior management had anticipated. In other words, the sales force has been throwing money away.

The large discount spread in exhibit 2 not only suggests that a significant opportunity in addressing pricing exists, but also that several accounts have low or even negative profitability. The sales team throw money away.

Reducing discounts in those accounts therefore does not expose the company to significant earnings risk. Although some of these accounts might be considered to be “loss-leaders”, more often than not there is no clear strategic rationale to justify these unprofitable accounts.

Price waterfall analysis yields opportunities and leakages

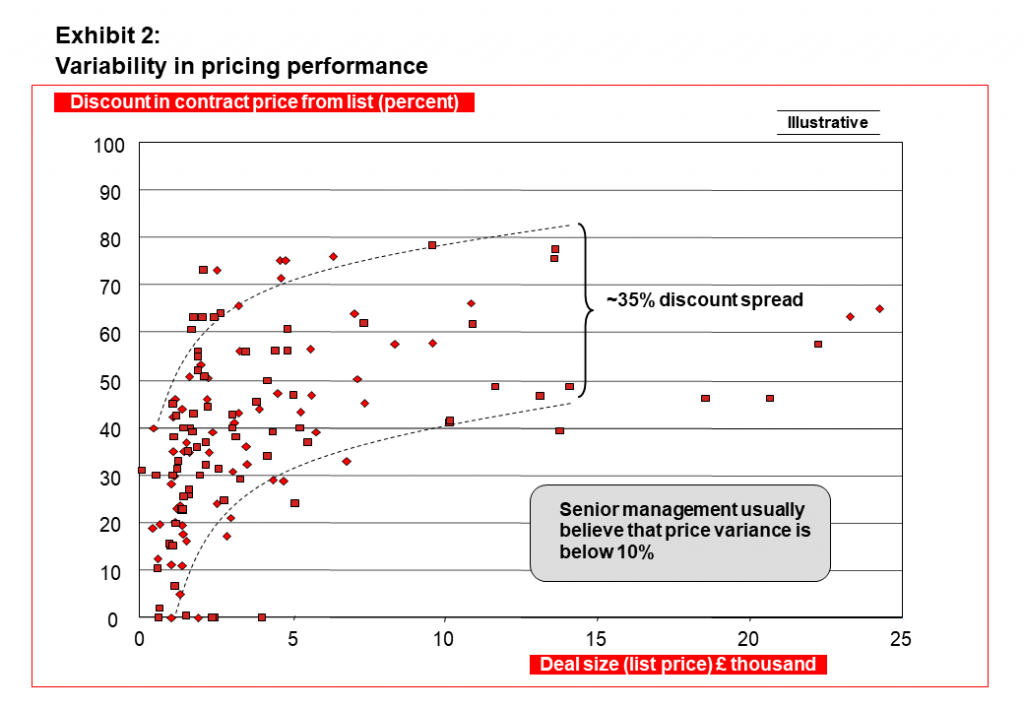

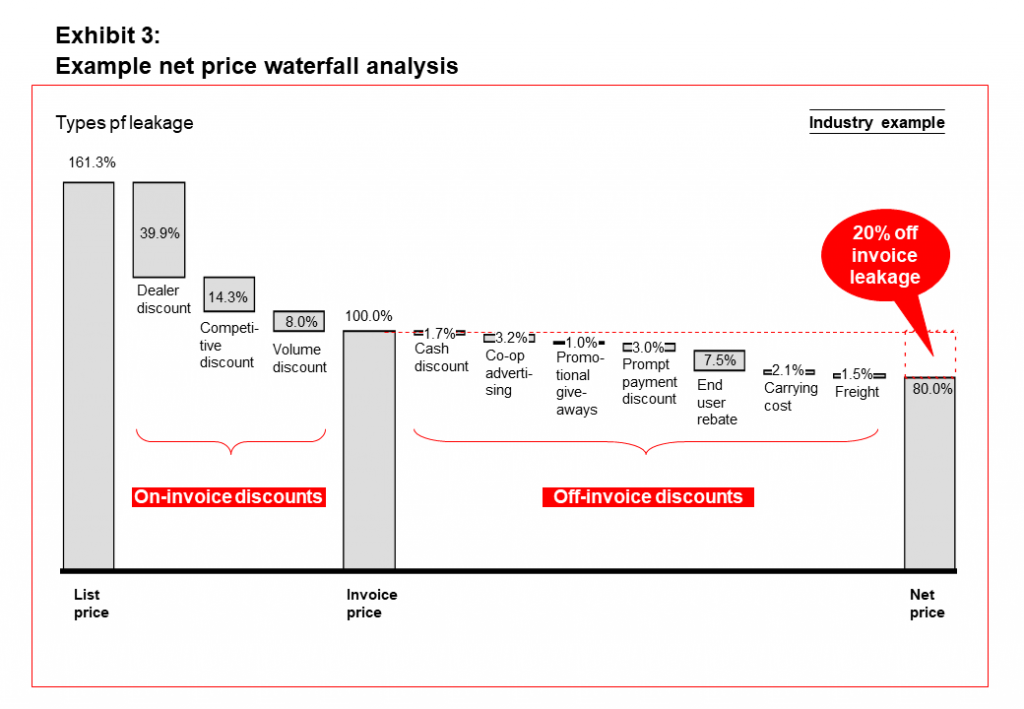

In order to estimate the size of the transactional pricing opportunity, a “net price waterfall” analysis such as the one shown in exhibit 3, can be employed. Exhibit 3 displays in graph form, all on- and off-invoice deductions in revenue that may accompany a transaction. Depending on data quality and availability, the “net price waterfall” analysis can either be conducted for all company transactions, or for a representative sample.

This analysis reveals:

- a clear measure of the maximum opportunity that can be achieved by eliminating price leakages, and

- the nature of leakages.

Once problem areas have been isolated, an action plan can be put against the highest priority opportunities.

Root Causes of Price Leakages

There are several potential root causes behind each type of price leakage. Consequently, the step following the net price waterfall analysis is to identify what the underlying cause of leakage is. The solution for transactional pricing problems must then be tailored to the specific root causes of leakage for each customer. For example, if the root cause of leakage is erratic sales force behaviour, setting firm pricing guidelines and developing processes to monitor ongoing field pricing practices is the first step. In such cases, appropriate training is required to generate awareness of the guidelines to enable sales people to make correct decisions when negotiating price points. Equally important is to diagnose whether the compensation structure supports perverse field incentives. For instance, a vast majority of companies suffer from sub-optimal sales force incentive schemes which reward the sales team for volume-driven selling rather than value-driven selling.

Volume over value

In one client situation involving a leading technology solutions company, the sales force was almost entirely compensated on sales volume, which resulted in frequent escalations to upper management and to various off-invoice giveaways to customers as incentives to buy. Through a combination of systematic account planning and sales force compensation realignment, the client was able to maintain sales volume whilst increasing profitability by 25 percent.

The quarterly push

In the case of a leading medical systems manufacturer, the field was compensated on meeting quarterly sales goals, which resulted in deep discounting at the end of each quarter. What is more, customers were “trained” to wait, and place their orders at quarter’s end, to receive better deals, thus throwing money away. his, the incentive scheme was revamped, and sales people were trained in ‘price-getting’ negotiation tactics. Additionally, using targeted analyses, the client developed a scorecard system that identified leverage points for each key account and provided guidelines on optimal discounting practices. The outcome was increased profitability, and a smoother rate of sales throughout the quarter, with the associated benefits for the supply chain of the business.

Capturing the Transactional Pricing Opportunity and Institutionalising the Changes

Consequently, to capture transactional pricing opportunities, a key requisite is a decision on the right net price to charge each customer or each customer segment. A price sensitivity analysis is necessary to uncover the true purchase willingness of each customer (segment). With spare parts sales, for example, the customer’s price sensitivity is determined, among other factors, by whether the customer orders a part in an emergency or as part of routine maintenance. Customers’ price elasticity also depends on whether they consider the purchase a large or small fraction of their overall budget, whether the replacement part is mission critical, etc. For the spare parts industry alone, we have identified more than ten criteria that affect customers’ willingness to pay and their responsiveness to price changes.

In general, determining customer (segment) price sensitivity involves systematically gathering and analysing sales data to uncover customer responses to price changes, as well as any product substitution and cannibalisation effects. The more segment-specific the sensitivity analysis is, the greater the customer insight and the higher the value-capture.

A final step is to understand what criteria drive price sensitivity for each product category. These criteria are then used to create sales support materials (e.g., scorecards) that are used by the sales force as a guide to making pricing decisions. In effect, these criteria help identify which customers fall into which price sensitivity categories, thereby allowing the field sales force to maximise its selling price.

Avoiding classic pricing execution pitfalls

- Any re-pricing effort should be first performed on a pilot basis, and then rolled-out with the appropriate modifications, based on feedback from the pilot

- Management should be actively involved throughout, especially in monitoring the effort’s impact to (a) provide the necessary visibility to internal stakeholders (e.g., field force, regional sales managers) and (b) assess the effort’s business impact, especially in light of the significance of the potential impact on the bottom line

- An interdisciplinary taskforce must take responsibility for the implementation of such a project. The team should be comprised of representatives from the marketing, finance and sales departments, with strong sponsorship at the executive board level.

Certainly, best practice pricing is always an iterative process, with changes in consumer behaviour closely monitored, the ‘pulse’ of the market is always evaluated through feedback from customers and the field, and the appropriate adjustments to strategy and execution are made.

It is surprising how many companies inadvertently and unknowingly “aid and abet” suboptimal pricing actions on the part of the sales force. Most sales forces still throw away money.

This article is a joint effort. I had the pleasure to collaborate with my friends Stephanie Wong and Dr. Mario Simon It was a great experience and these guys are true experts.